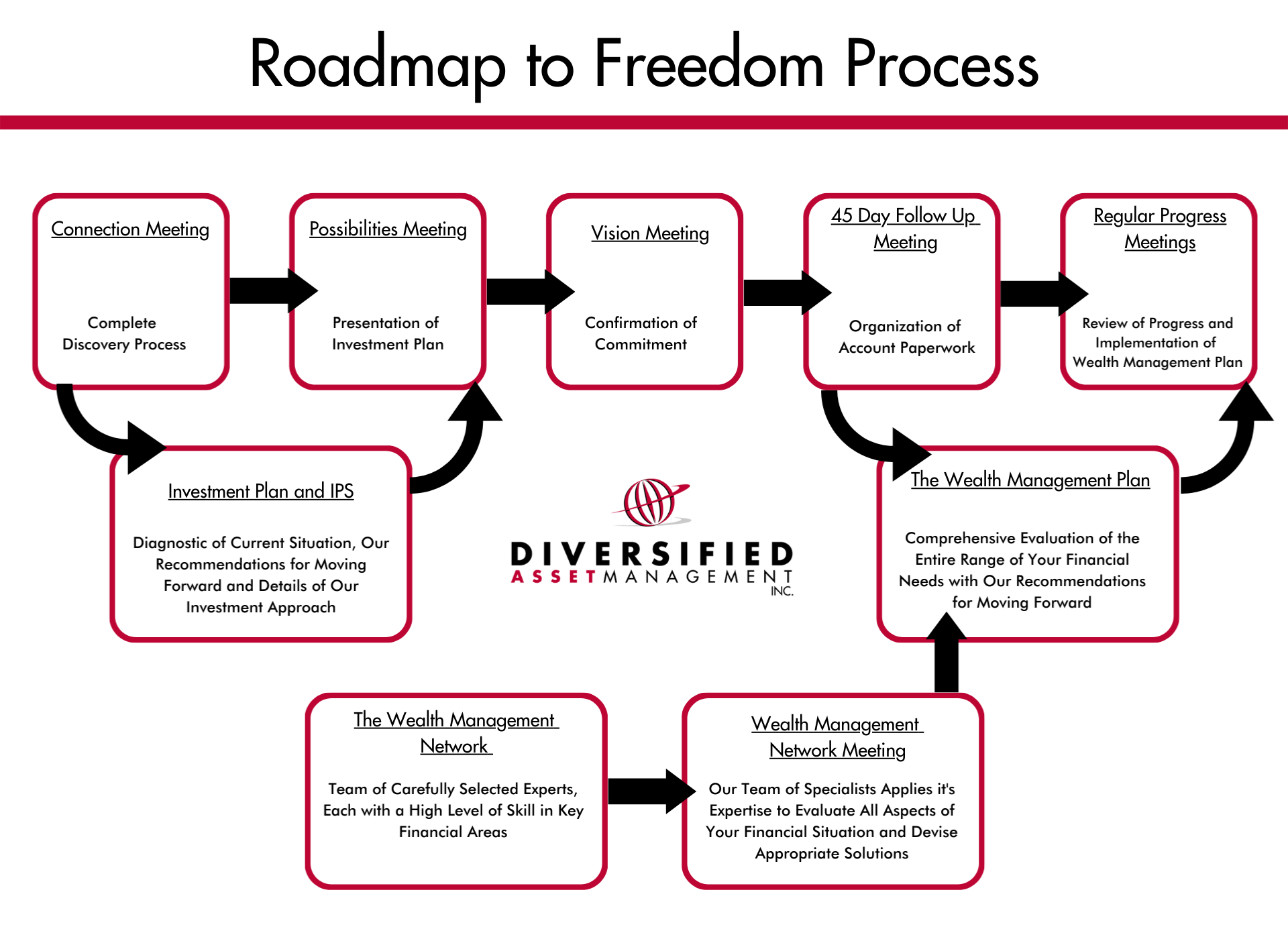

Our roadmap to freedom Process

Effective wealth management is based on a continuous process that lasts a lifetime. When you go at it alone, you’ll never know what is truly possible for you and your family. We are committed to showing you more than you thought was possible and we will hold you accountable to make sure you achieve it. The Advanced Planning Plan is designed to provide a roadmap to freedom with specific steps to help enhance, transfer, and protect wealth. This personalized roadmap assists with the many financial decisions that come with changes and transitions over a lifetime, listed below or by clicking here.

Wealth Enhancement

Portfolio & Investment Management

ESG Investing

Financial Planning

Transition Planning

Retirement Planning

College Planning

Tax Planning

Retirement Plan Setup & Administration

Non-Liquid Asset Management

Job changes (new job, job loss)

Major purchases (home, car, business)

Wealth Protection

Quantify Exposure to Risks

Asset Protection

Risk Management

Life Insurance

Health Care Review

Long Term Care

Disability Insurance Review

Auto/Home Owners Insurance Review

Umbrella Liability Insurance Review

Wealth Transfer

Estate Planning

Trust Management

Legacy Building

Beneficiary & Executor Review

Real Estate Advice

Business Succession Planning

Estate Settlement Advice (for after death)

Receiving an inheritance

Retirement

Tax law changes

Charitable Planning

Discuss and Explore Long-Term Charitable Wishes

Philanthropic Planning

Team of Experts Referrals

Estate Planning Attorney

Certified Public Accountant

Life Insurance Consultant

Property & Casualty Insurance Consultant

Our team works in concert with each client’s professional team—accountants, attorneys, insurance agents, etc.—to develop a customized Advanced Planning Plan that serves as the roadmap for addressing each of these challenges. Each plan includes four key areas of focus:

Wealth enhancement aims to produce the best possible investment returns while considering particular risk tolerance tax mitigation strategies. We use a consultative process to identify each client’s current financial situation and challenges, and then work with a team of experts to design solutions to help achieve critical goals.

Wealth transfer focuses on identifying and facilitating the most tax-efficient way to pass assets to succeeding generations, and to do so in a way that meets the wishes of the client. Working together with the client and the client’s attorney, we complete the necessary paperwork to update accounts to reflect estate planning wishes, including beneficiary updates, trust accounts, and account titles. Ensuring accuracy with these details helps ensure wealth is transferred effectively to provide for the client’s family and other beneficiaries according to his or her wishes.

Wealth protection is aimed at protecting assets against potential creditors or litigants, as well as protecting against catastrophic loss through the effective application of life, disability, umbrella, and other insurance products.

Charitable gifting helps fulfill charitable goals and can often support efforts in other areas of the Advanced Planning Plan. In coordination with each client’s attorney, we can change beneficiaries as needed, set up donor advised funds, or assist in any other areas as needed.